Industry

Insurance

Mortgage Lenders

Real Estate

Financial Planners

Contractors

Auto Repairs

Accountant

Pricing

Enterprise

Get Demo

It’s a good idea to shake up your marketing strategy if you want to improve your bank. There are several strategies to attract new clients, including social media, digital marketing, and outbound content. Inbound marketing should also be given priority because it is a fantastic method of capturing new consumers that are already interested in the financial services you have to supply. For your convenience, we’ve put together a list of 13 of the most effective marketing methods for your financial institution.

A digital marketing strategy is a lot more efficient, trackable, and cost-effective than traditional marketing and advertising approaches like pamphlets, billboards, and media advertisements that need a large investment and/or a lot of manual effort. A digital marketing approach may be used to contact your target audience through various channels such as email, social media, search engine optimization (SEO), and content marketing.

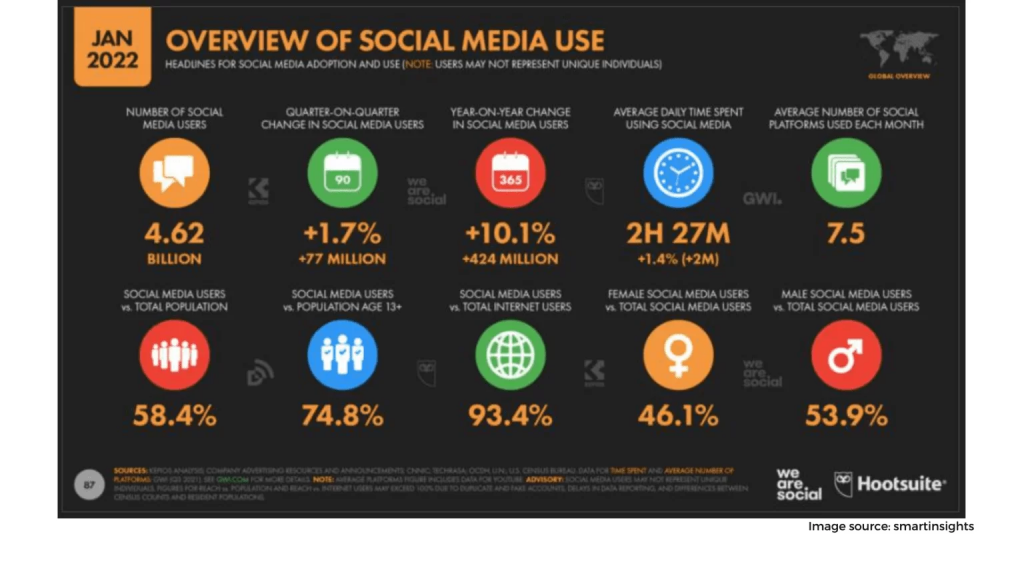

You may use free internet marketing platforms to promote your brand and draw upon an unrestricted number of prospective consumers who are interested in the field you specialize in. You’ve got a captive audience if you know how to engage them, since the typical person spends two hours and 24 minutes on social media every day. Of course, that’s the tough work — and the only way to learn is to test out various things until you figure out what works best for you. If you can project a positive attitude across social media, this may be your opportunity to monetize that talent.

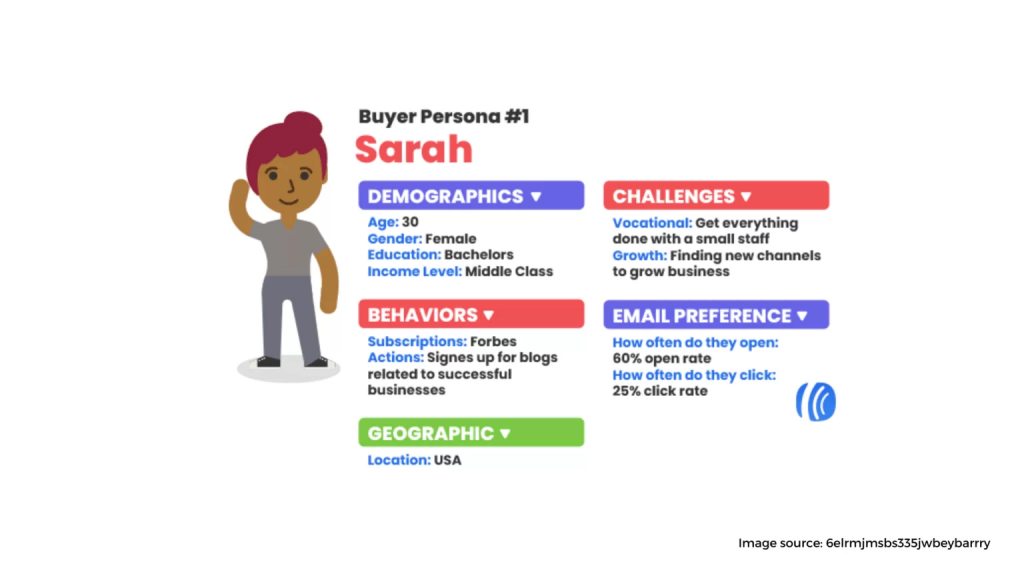

Knowing where you stand in the market and how to set yourself apart from the competition can help you plan your marketing efforts. If you deal with a lot of high-net-worth customers, for example, you may modify your financial planning services to topics that are most relevant to them. Clients with modest incomes, on the other hand, will confront a variety of pressing problems. These are just a few of the apparent instances; however, you may apply similar methods to study in greater depth. Consider carefully about the demographic most likely to look for you if you specialize in long-term care funding – not those receiving care, but their children (who may be in their 40s, 50s or 60s).

Begin by creating a mental image of your ideal customer(s) and personalizing all of your marketing communications as though you were speaking with them in their native tongue.

Despite the fact that it has some disadvantages, Facebook may be a useful marketing tool. If utilized correctly, it and other social media sites can help you reach a large number of new prospects. Various age groups have different tastes, so doing your market study to figure out how to appeal to your target demographic is worthwhile. Regardless of channel you pick as a financial counselor, make sure you update your content on a regular basis to ensure that your brand is seen in their feeds. When posting anything of value that can inform, inspire, amuse, or persuade others, always aim for excellence rather than quantity. Being seen is the most important part of public relations; you can’t do this if you don’t use social media. The best financial advisors have a plan in place for providing excellent services. Investing portfolio administration, financial goals planning, exchange traded funds, personal finance, and tax planning are just a few of the services available. Viral marketing refers to any technique that encourages individuals to pass on a marketing message to others, creating the potential for exponential growth in the message’s exposure and influence. It is word-of-mouth delivered and amplified online through social media.

Your efforts may be in vain if your website is difficult to navigate, out of date, not optimized for mobile users, and does not address important consumer queries. Even a single spelling mistake, according to one study, can reduce sales by 50%, so care should be taken.

A bad website may harm your conversion rate (how many of your leads turn into paying clients), therefore it’s critical that you address the situation as soon as possible. If you’re not comfortable with web design and don’t want to hire a designer, professional assistance will most certainly pay off.

Make sure you’re prepared for an increase in new inquiries and consumers before you invest a lot of time and money into your new website.

Are you unfamiliar with the idea of search engine optimization (SEO)? It’s a strategy for ensuring that as many new people as possible are aware of your website. Here’s how it works in practice. As a certified financial planner, you want to be the first financial planner that comes up when someone searches for “financial planner in (your city)”

Let’s assume you run a financial consultancy in Bristol, for example. Most likely, potential clients are looking for “financial advisers in Bristol” when they search on Google. Using this term in a natural way, along with other prominent keywords, can aid your ranking (how high up the search engine results page you appear), making it easier for new leads to find your business.

SEO may be an art as well as a science. The objective of focusing on niche terms that few websites have addressed is to decrease competition and enhance your ranking probability. This is a fantastic opportunity to demonstrate your professional expertise.

Developing rapport with financial professionals who share your interests or are in similar businesses is a tried-and-true approach to increase your new prospects. It’s especially important if financial experts spend a lot of time dealing with commercial clients since you may connect with them and start up an informal discussion, which has the potential to lead to new business.

You may also join the financial community by forming connections with other IFAs all around the world, which might lead to new business. Assume you’re based in Edinburgh but have a strong relationship with a London-based advisor. You’ll be at the top of their list if one of their regular clients or another individual in the neighborhood who has heard great things about them asks about working with you.

Being included in a directory (such as Unbiased) can help you improve your profile. Some clients want to look for their adviser on their own and make their decision, so having this alternative as well as a lead generating service may result in double the queries. Furthermore, a well-known directory with strong SEO may allow you to appear more often in local search results.

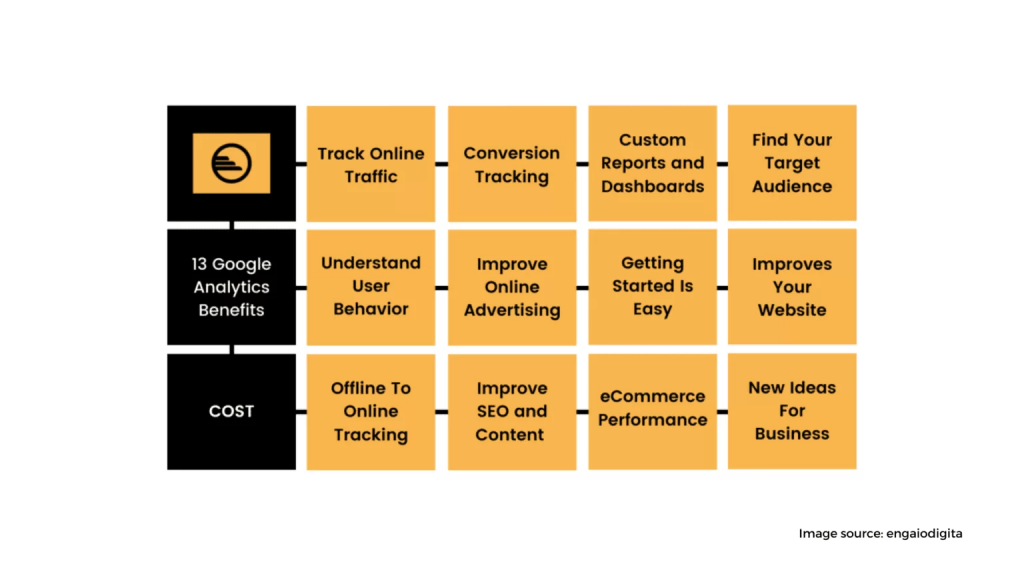

It’s a waste of time to spend hours upon hours developing marketing campaigns if you don’t track your results. Before implementing a new marketing research approach, look at important marketing indicators such as interaction, website traffic, and conversion rate. Financial advisors are dependent on the analysis of certain key marketing metrics.

You can keep track of these numbers to see if they’re going up, suggesting you’re doing the correct thing; or staying the same, indicating that this isn’t the most effective approach to attract new consumers.

Inbound marketing, on the other hand, is a more covert technique for investment advisors to entice their audience to interact with their product or service in order to assist them with their financial planning demands. All types of marketing, from advertising to cold calls and emails, loudly declare that an investment advisor is providing a solution. Inbound marketing is a way of interacting with your audience while also providing value for their time by utilizing platforms like blogs and social media sites, which enhances brand loyalty.

People will be more likely to visit your website if you give valuable information on areas where you have expertise, such as retirement planning or investing for novices. They’ll discover something fascinating and may discover a new customer by offering up just a little of your knowledge for free.

Do you find yourself as a financial advisor, struggling to come up with leads on your own? Joining a lead generation platform (such as Unbiased) may help you attract new consumers to your company.

You’ll be introduced to clients in your local region who need your services, ensuring a steady flow of work.

Furthermore, the excellent reputation of your selected lead generating platform will be associated with your brand. Customers are more likely to trust you if they believe that the site only invites qualified, experienced professionals than if they happened upon your site by chance while surfing the web.

This is one of the mildest marketing approaches, yet it has a high potential for long-term success. Take the time to develop existing customer connections and you’ll encourage not only repeat business but also word-of-mouth advertising as they discuss you with their friends. There are various ways to do this, including:

The secret to doing client outreach correctly is to avoid making each email sales-oriented. It’s all too easy to include a call-to-action at the end of every message in order to increase revenue, but it will seem artificial and pushy. Take the time to check in without seeming like you’re rushing someone; simply seeing your name may remind your clients it’s time to schedule another appointment.

Your specialty as an IFA is, in essence, personal finance. You’re in the majority if marketing isn’t your thing. As you would advise your own clients, consulting a specialist is usually the best way to go forward.

To help you figure out where you’re currently successful and where some improvement is needed, you might pay a freelancer or engage a marketing agency. This should enable you to create a professional-level investment management marketing plan.

There you have it: 13 possible marketing ideas for your IFA business. It’s now up to you to determine which of these approaches will work best for your company, based on the products and services you offer, your target market, and your budget.

When it comes time to implement these ideas, take things one step at a time. Overwhelm can quickly set in if you try to do everything at once. Remember that success seldom happens overnight; focus on building a solid foundation so that you can slowly but surely grow your business and its own financial life into something great.

Many individuals underestimate the role of a financial adviser in their financial success strategy, which is probably why the overall financial services industry success rate hovers around 12%.

However, the Bureau of Labor Statistics (BLS) predicts that employment in the industry will rise by 5% over the next ten years! As a result of the higher demand, supply is increasing. Phew, there's some relief there. Oh wait, this also implies that there will be 21,500 financial advisor job openings every year for the next 10 years!

Before you start blaming the heavens and decrying my dismal statistics, allow me to inform you that the key to standing out among your competitors is nothing more than a well-planned digital marketing strategy made up of all of the essential financial advisors marketing tactics carried out correctly!

What is the best way to get into financial services? How can I market myself as a financial advisor in an industry where competition is high and reputation is essential? Want some more pointers on what marketing for financial advisors entails? Great! Here are three things to bear in mind when developing a fool-proof marketing plan:

1. Define your brand value and offering

2. Identify customer expectations and pain points

3. Identify your target audience

It appears to be a lot of effort, doesn't it? Ah, how simple life would have been if there was a numbered strategy list that went through all the essentials in depth? You've come to the correct location! We'll go over 8 easy and effective marketing tactics for financial advisors that you can use right now to grow your client base in this blog!

How about taking a peek outside through the curtains before the show begins in all of its splendor? Here's a list, especially for you, of the tactics we'll be discussing:

w skilled you are at your job, it's practically impossible to attract consumers if they don't know that your company exists in the first place, isn't it? Marketing is critical for any business to thrive. But, as a financial advisor, how can you market yourself? Here are some methods for making your company more discoverable:

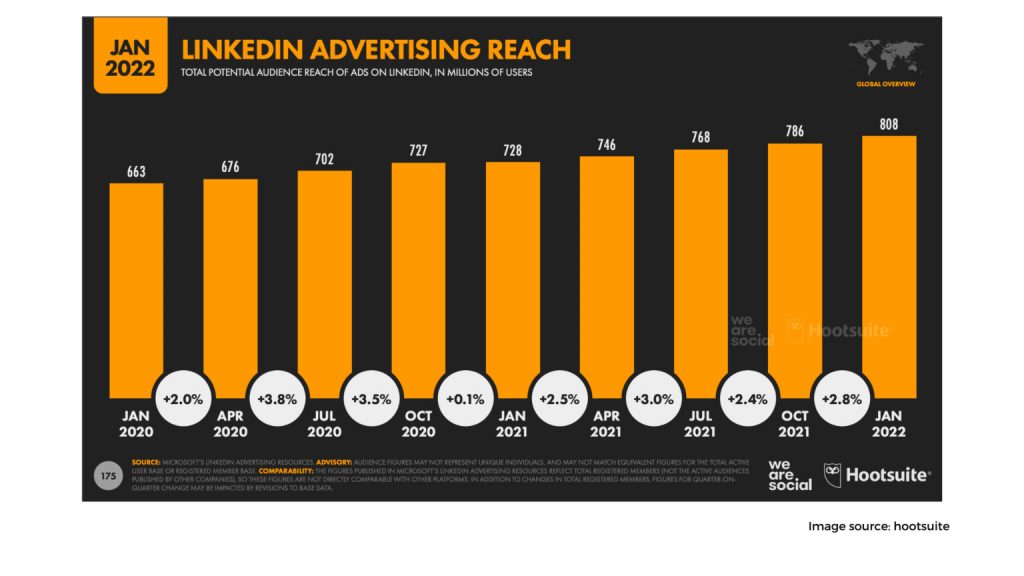

Ah, now comes the time to address the elephant in the room: social media! If there's ever a list of the top ten digital marketing ideas for financial advisors, or a how-to guide on online marketing for financial advisors, social media tips and techniques would most certainly be near the top in both cases.

We realize that social media marketing may be overwhelming at times! Many financial advisors marketing plans have been damaged since this was not done in a professional manner. Here's a list of things to keep an eye on so your strategy is completely bulletproof:

Why is it that the majority of financial advisors' marketing ideas revolve around generating new leads while retaining clients and ensuring recurring revenue? This is extra essential for financial services, where each year a lot of things change for the consumer. Here are some pointers to keep your consumers loyal:

Did you know that nearly 80% of B2B marketers have a content marketing strategy, but just 43% have written their plan down? The biggest blunder in content marketing is not getting the fundamentals correct!

We all know about blogging, which is one of the most essential components of a content marketing strategy that must be part of your financial advisor marketing plan as a whole. What, on the other hand, is the correct approach to do it?

Blogging is all about educating, not promoting, so many individuals fail to comprehend it. Here are a few things to check for to ensure that you're doing things correctly:

You can also start using more advanced digital marketing techniques such as writing eBooks/white papers, conducting webinars, filming videos, and doing podcasts to increase interaction once you've mastered the basics. But first make a blogging schedule and stick to it. Remember that once your material is published, it's likely to stay online for quite some time; therefore, give it your all!

With the improvements in technology and fueled by the pandemic hyper-personalization, maintaining a high level of personal contact has now become an important trend across many sectors.

Essentially, hyper-personalization is about making sure that the message and experience are tailored. You must embrace this development, according to numerous financial advisor marketing materials. Here are a few methods for doing so:

During a pandemic, one-on-one meetings, client events, and movie nights may be difficult to arrange! Using video conferencing services like Google Meet or Zoom as a substitute might work well.

One of the most essential marketing recommendations for financial advisers is to optimize your website. Keep in mind that, while developing your website, you should always think about the target audience.

According to a Broadridge Financial Solutions poll, nearly two-thirds of advisors who get leads through their website consider their websites ineffective, demonstrating that website optimization is an ongoing process.

Here’s how you can optimize your website:

Pro-Tip: While you could use several other phrases as a call-to-action on your site, including "book now," "get more information," and so on, the client booking a free session with you is ideal. As a financial advisor, adding a book now button to your website is one of the most effective CTAs you'll ever need in your marketing arsenal.

Networking, in the opinion of many people, is one of the most crucial and frequently neglected components of financial advisor promotion methods. People may not be aware that networking is what it's all about! Contrary to popular belief, having a "perfect list of clients" isn't necessary for networking. In reality, establishing valuable connections is at the heart of networking regardless if they provide immediate value to your organization or not.

As beautifully expressed in this passage, the goal is to nurture such connections so as to profit from them in the future by creating a win-win situation.

Here are a few ways through which you can get started on networking:

Another essential component of this list of financial advisor marketing tactics is to measure the correct numbers. Keep track of metrics that will help you assess your success. A new entrant in the sector, for example, may simply be concerned with bringing and converting new customers, in which case he should keep track of how many leads he uncovers and where they originate from.

Keep track of how much money you make per direct outreach. Assume that you call around thirty prospects and get three appointments. One person becomes your client out of the three appointments, resulting in a profit of $500. Let's assume that the customer paid you $500 because to that particular sale. We understand that managing, collecting, and storing so much data can be time-consuming. Don't worry, we've got you covered! The entire process becomes simple and error-free when Appointy is combined with Google Analytics! Please have a look at it!

You may make 500 dollars for every 30 phone calls you make if you average the cost per call. Now that you've turned everything around, you see that each time you call someone up, you're making about $17! Isn't it incredible? This is an important marketing approach, and besides, some of your financial planning abilities will be required here!

As a financial planner, this is an easy marketing method to implement, since all it involves are numbers! Follow the same procedure as seen in the example. Determine how many calls it takes for you to set up an appointment. Then calculate how many appointments you'll need to convert that single lead into a client, and there you have it! You now know precisely how much money you make per phone call.

Phew! That was a show to remember, wasn't it? Perhaps I got carried away there, but hey, what's life without some enjoyment? And coming back to the main point of the blog, look at that famous saying: "To each his own."

You may never know what works best for you, so keep seeking for new fresh financial advisor marketing ideas and trying different things in order to find your own tried-and-true financial advisor marketing technique that works best for your company!

Finally, the epidemic has digitized the wealth management business. It's time to adopt technology as part of your marketing efforts if you haven't already! Digital marketing services can assist your financial advisory firm in managing and executing these ideas , so please reach out to us if you want help in bringing your ideas to life.