Industry

Insurance

Mortgage Lenders

Real Estate

Financial Planners

Contractors

Auto Repairs

Accountant

Pricing

Enterprise

Get Demo

Financial services marketing has gone through a dramatic shift as a result of digital transformation, bringing you closer to your customers than ever before. Getting these connections correct at each step of the consumer’s path is critical for digital marketers when it comes to financial planning marketing. Financial advisors need to focus on inbound marketing methods that attract their target market through beneficial and helpful content. Social media marketing , email marketing, and SEO are all significant in helping advisors connect with individuals who may be interested in their services.

If not, you may be missing out on key opportunities to reach a wider audience and attract new clients.

In order to stand out in the digital world, your marketing strategy must be sound. It should be built on a strong foundation that can support your long-term success .

There are many essential elements to include in your financial services marketing strategy, but these five are critical:

1) SEO-Optimized Financial Advisor Website

2) Compelling Content

3) Presence on Social Media Platforms

4) Email Marketing Strategy

5) Pay-Per-Click Advertising

Let’s take a more in-depth look at each of these essential financial advisor marketing ideas.

1) SEO-Optimized Website: In order for your site to rank high in search engine results pages (SERPs), you’ll need to make sure it’s optimized for search engine optimization (SEO). This means including relevant keywords in your site content, as well as making sure your website is mobile-friendly and loads quickly.

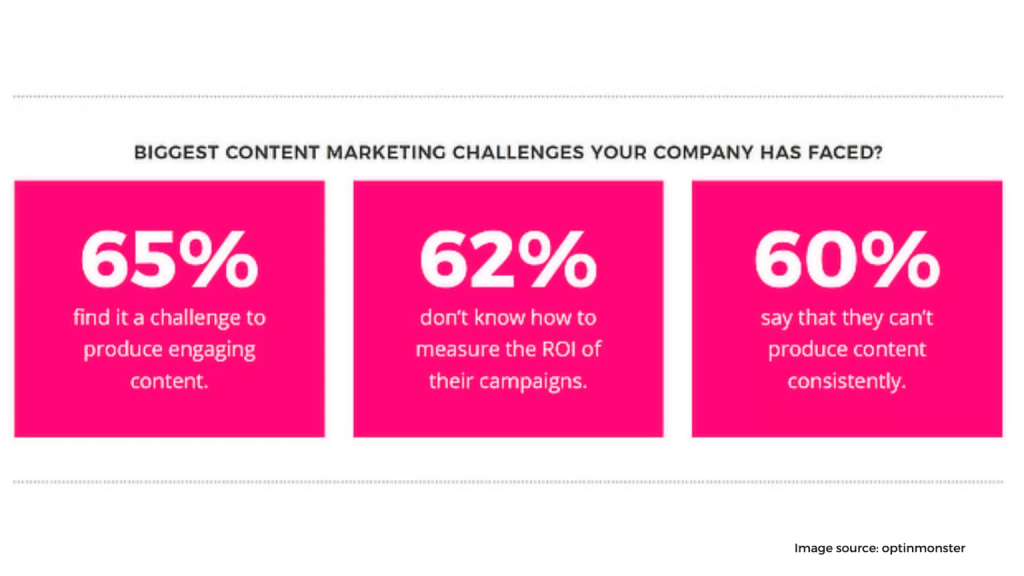

2) Compelling Content: Your website content needs to be interesting and informative if you want visitors to stick around. It should address the needs of your target market and provide them with valuable information. financial advisor blog is a great way to generate fresh, relevant content on a regular basis.

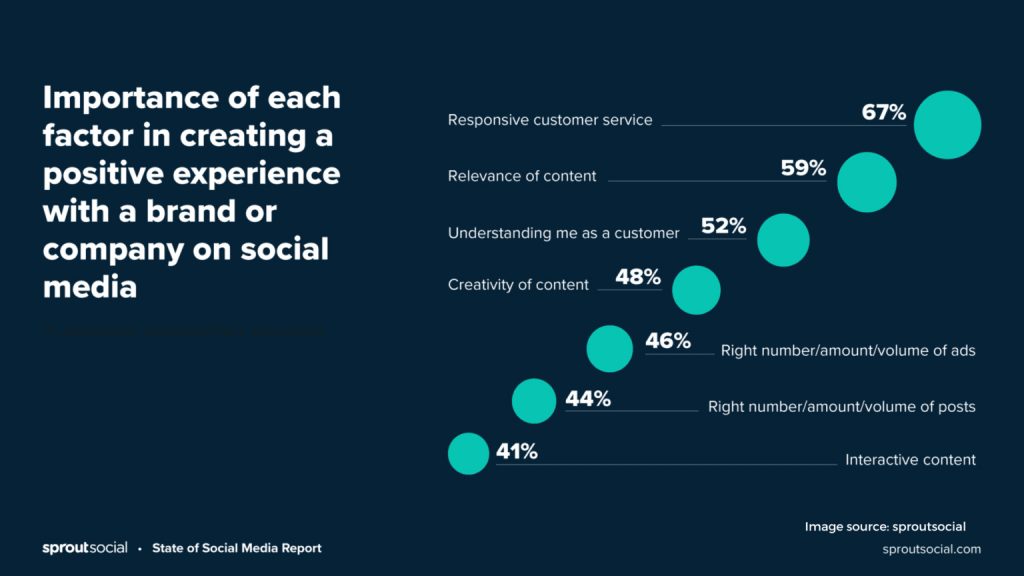

3) Presence on Social Media Platforms: Social media provides an excellent opportunity for financial advisory firms to connect with potential and current clients. It’s also a great way to build brand recognition and share your story and build trust with your social media followers. Make sure you’re active on the platforms that your target market is using.

4) Email Marketing Strategy: Email is a powerful marketing tool for financial services companies that can help you stay in touch with your clients and build relationships. Make sure your email marketing strategy includes a way to capture leads, as well as automated emails that keep your clients engaged.

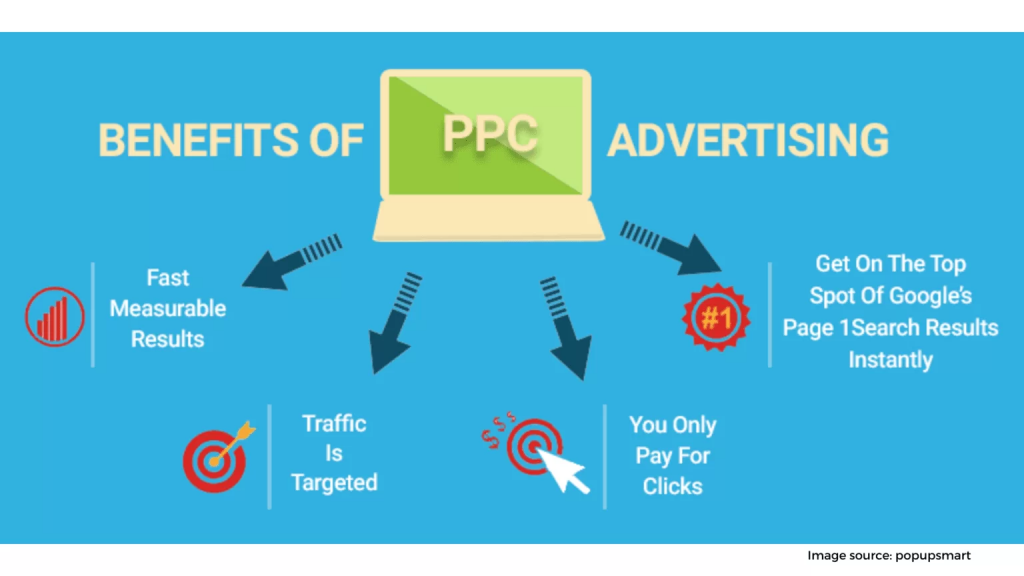

5) Pay-Per-Click Advertising: Many financial advisors utilize this approach. Pay-per-click (PPC) advertising can be an effective way to drive traffic to your website and generate leads. When done correctly, PPC can be a cost-effective way to reach your target market.

To reach and convert financial services consumers, you need a well-defined value proposition that is effectively conveyed and backed up by digital technology. Many finance firms are adopting next-generation technologies to mitigate growing expenses and accelerated tempo pressures following COVID-19.

As a result, marketers are operating in an era of technology progress, greater technological productivity, and platform modernization. In these times of change, marketing executives must assume the position of the client and maintain these essential stakeholders at the center of every business decision.

This isn’t a one-size-fits-all case. In fact, as the preceding article demonstrates, there may be applicable lessons to be learned in the world of technology. The tech ‘platform’ architecture, for example, can also be used in the financial services sector, or retail. As outlined below, this is not limited to the business-to-consumer world, but also has applications in the business-to-business realm.

In the banking scenario, the customer journey platforms represent a customer’s encounters with financial products and services – what they want and use. While not all Core IT platforms are ‘marketing owned,’ they do enable these procedures from the client perspective.

Customer experience management and targeting are also influenced by the majority of CMS/ECM platforms, as well as public cloud services such as Amazon Web Services. This includes information from customer support channels, chatbots, social media posts, and reviews in addition to marketing data.

Streamlining these platforms’ operations so that they can operate more successfully and profitably is the goal of Digital Transformation.

Reach: To increase the number of people who are aware of your brand and understand what you do (your target market).Act: To turn prospects into leads by getting them to take action, such as subscribing to a newsletter or requesting more information.

Convert: To convert leads into customers by persuading them to buy your product or service.

Engage: To keep customers coming back by building relationships and creating loyalty. The first step is to set your overall objective, which could be anything from increasing awareness of your brand to

In the face of Digital Transformation in the financial marketing sector, I strongly recommend that you approach your financial marketing planning using the RACE Framework. RACE marketing planning allows you to review your digital marketing strategy over the entire financial customer lifecycle.

The RACE Framework is crucial to your financial marketing plan because the content and distribution methods you use will be different according to the stage of your relationship with the customer. See the below, taken from our Digital strategy success factors Learning path.

So, how can you kick-start your financial services marketing? The answer is, of course, a data-driven, strategic marketing plan. That’s what we’re here for today.

This strategy has five components and details the deliverables for each. If you believe that one area of your financial services organization is weak, you may choose to concentrate on it more, or arrange a plan that covers all five elements.

You may have heard of the term “SWOT,” but what exactly does it mean? In a nutshell, it’s a tool that helps you analyze your company. SWOT analysis compares internal strengths and vulnerabilities with external possibilities and threats in the financial sector. We also suggest that Smart Insights members utilize the TOWS resources to strategize their operations. As a financial advisor looking for prospective clients in the financial services industry, it’s important to understand your target audience.

That involves creating buyer personas, which are semi-fictional representations of your ideal customer, taking into account factors such as their age, income, location, and interests. Once you’ve created your buyer persona, you can start thinking about how to reach them through various channels. Are they more likely to read industry news online? listen to podcasts? or attend webinars?

The TOWS matrix assesses internal strengths and limitations (green) and external opportunities and threats (blue) around the edge, as well as four main boxes for developing market strategies.

It’s critical to plan your financial marketing vision and goals in tandem with your overall strategy. Keep in mind what metrics you’ll be using to track progress. The educational mnemonic VQV may assist you in defining the metrics used to rank on a volume, quality, and value basis.

REACH metrics such as unique visitors can only show you so much – whereas the bounce rate and the revenue per visit are much better indicators of the quality and value of your visitors.

However, merely recording sales volume is insufficient in assessing the success of your CONVERT marketing. The percentage conversion to sale or sales value is one way to assess the quality and value of your sales.

The true value of digital marketing becomes apparent with segmentation and targeting. The degree of precision targeting available to today’s marketer is remarkable. Consider this in the context of the customer lifecycle RACE Framework, and you’ll get a glimpse at just some of the possibilities that RACE planning opens up.

In the following scenario, segmentation and targeting may be used on marketing data throughout the customer ENGAGE experience.

You can use financial marketing ideas flux to your advantage if you have the required strategic plan in place for potential clients.

Financial services marketing is essential for any business in the industry. The process can be daunting, but if you break it down into manageable steps, you’ll be on your way to success in no time.

If you need help getting started, or would like some assistance along the way, there are digital marketing services that can help you with your financial services marketing needs.

Digital marketing for financial services is a complex and ever-changing landscape, but with the right mix of strategy, creativity, and technical know-how, your business can navigate it successfully. Keep these tips in mind as you develop your own digital marketing plan, and you’ll be well on your way to reaching your target clients and growing your business.

Financial professionals are always looking for new ways to attract clients and grow their business. SEO (Search Engine Optimization) is a great way to do this.

Using SEO, investment advisors may achieve a lot of benefits. It’s an effective digital marketing strategy since it may help you outperform other financial planning services in search results. It’s low-cost because it may bring people to your site who would otherwise pay hundreds if they saw the commercials to achieve their financial goals.

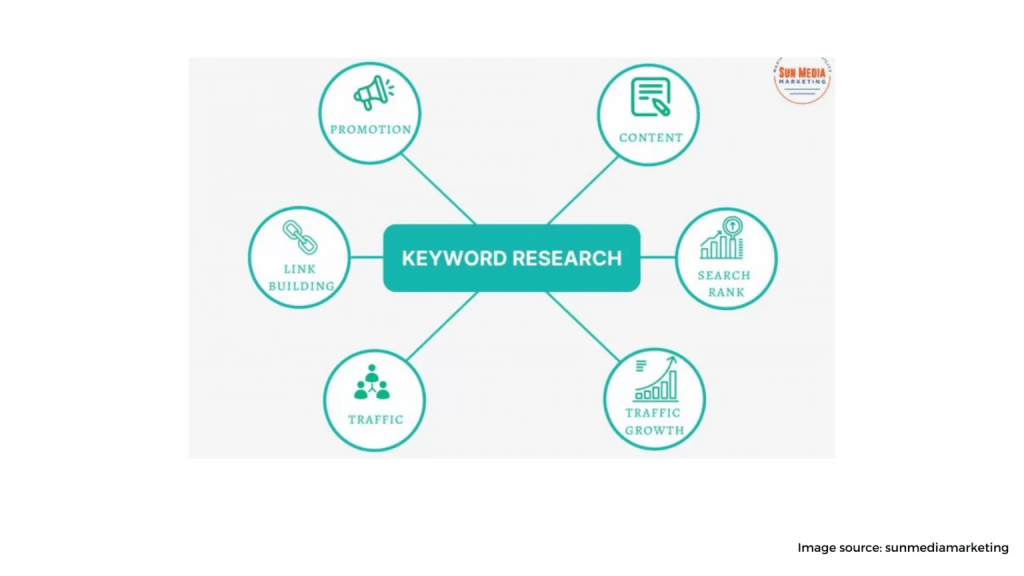

This is the most crucial stage. The lifeblood of search engines are keywords. When looking for a financial advisor, potential customers do the same thing by inputting keywords into their search bar.

Market research is important for any business, but it’s especially crucial for companies that rely on the web.

In my opinion, the following two metrics are the most crucial for keyword analysis: Volume and keyword difficulty.

Here’s an example for you:

Volume and keyword difficulty results for “investment advisor dallas”.

In this case, the most-searched term is “financial advisor Dallas,” with 170 searches per month and a keyword difficulty of 55.68, which means it shouldn’t be too difficult to rank for that keyword.

Keep in mind that keywords with a low keyword difficulty are usually easier to rank for. For example, if I was new to SEO and wanted to aim for 60 or below, that’s the first place I’d start.

Because many SEO specialists consider keyword complexity to be an important ranking signal, it’s unlikely that you’re one. Leave that work to the experts.

It’s critical to get the low-hanging fruit out of the way in order to build some SEO juice. I’m going to show you a keyword for “financial advisor Chicago” in this example, since the term is more difficult to rank for in Chicago than Dallas. As you can see, financial advisor keywords are tougher to rank for in Chicago than Dallas — and it’ll take additional effort if your keyword difficulty rating is higher.

Results for a financial advisor who wants to rank for “financial planners chicago” in terms of volume and difficulty.

Advisors have used the “content is king” concept to an unhealthy degree throughout the last decade, but it’s true: The internet belongs to content, and the objective of a search engine is to organize and distribute relevant material.

You want to incorporate your chosen keywords into your content in order to show the search engine that it’s relevant. However, don’t make your page jam-packed with keywords; this is known as “keyword stuffing,” and search engines can penalize you for it. Instead, concentrate on offering well-written material that incorporates a few natural but strategically positioned keywords.

Write your own material, but if you can’t, don’t be cheap. You may either spend a few dollars per click or $100 to $300 for an excellent piece that will continue to deliver and attract visitors over time. If you want to succeed, you must play the long game.

SEO needs material. The fundamental SEO principle is the use of keywords, and content is a useful way to utilize keywords. Writing relevant, valuable content for real people with genuine value who just so happen to use your keywords is what great content marketing is all about.

I am going to be honest about it, because it works.

Well, it’s back to the old slogan that I’ve been hearing for a while now: “high-quality content.” Everything has to be white hat, or high quality, for search engine updates in the future. Take my word for it: Those who try to game the system are inevitably crushed.

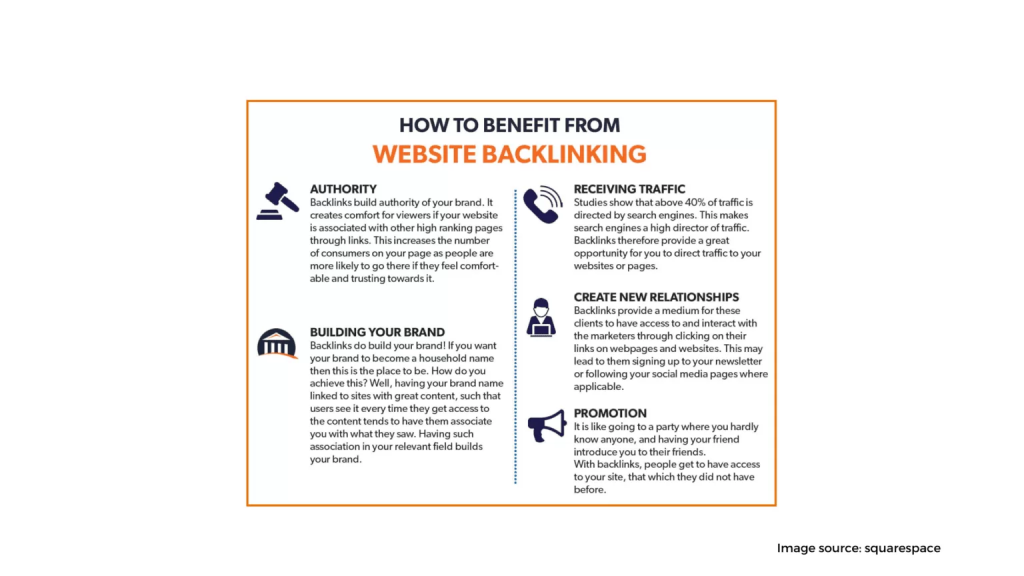

Another SEO principle is obtaining backlinks. Backlinks are links from other websites to your website. They inform search engines that another site believes your material is valuable enough to link to it, indicating authority and allowing you to rank higher.

The quality of your backlink is directly related to how relevant the linking site is. That’s why it’s not a good idea to spam websites and directories with irrelevant links.

In general, search engines prefer natural connections formed over time rather than hundreds of low-quality backlinks. You don’t want to make thousands of low-quality backlinks or purchase them.

The internet has been a wild west since its inception, and scammers have always tried everything to get around it –– from link farms to purchasing other domains, to hidden links. Search engines, on the other hand, are getting smarter every day.

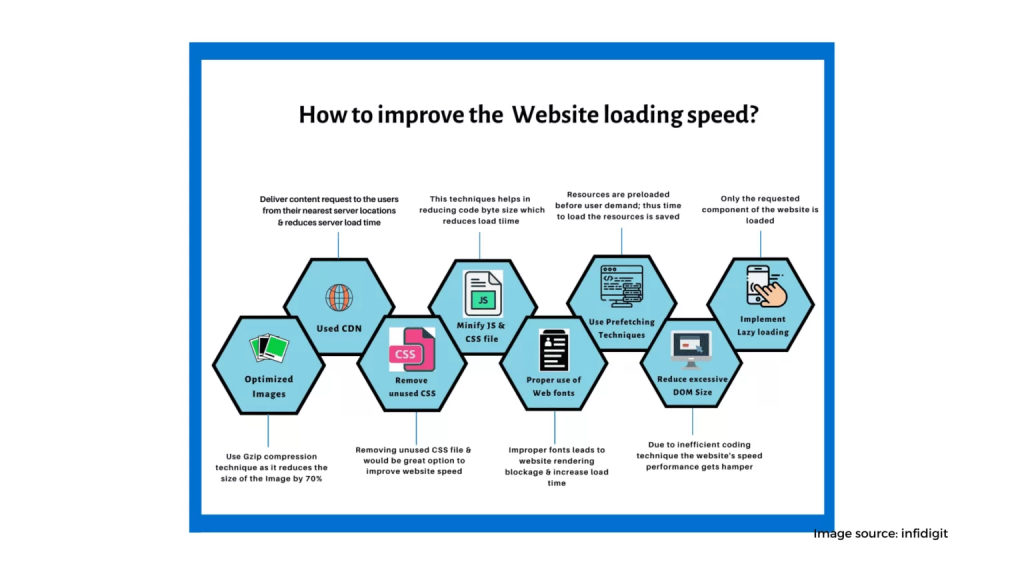

Google has stated that one of the signals utilized by its algorithm to rank pages is site speed. As a result, if your website is sluggish to load, it might have an impact on your rankings. Brand loyalty is essential for success, and people are more likely to be loyal to a brand that provides a good user experience. Online marketing strategies should focus on providing a positive user experience, which can be achieved by having a fast website.

A recent study showed that 40% of internet users will leave a page if it takes longer than 3 seconds to load. If you want to keep your visitors on your site and improve your SEO, you need to make sure your website is loading quickly.

A meta description is a short description of a website that appears as a preview in search engines. It’s made up of an HTML tag, which search engines display as a preview.

Meta descriptions are essential since they encourage visitors to click on your material. Financial advisors may enhance their SEO by creating click-worthy meta descriptions, as search engines consider you more worthy of higher ranks if more individuals click on your content.

Here are some pointers on writing better meta descriptions:

Additionally, make certain your descriptions and content match; you don’t want to mislead someone into clicking on your link, since they will click and bounce back swiftly, which is bad for rankings.

I’m about to share something that will revolutionize the way you “do SEO” and significantly decrease your learning curve. If you’re serious, I recommend that you read this carefully and take action.

This is an awesome way to get links quickly.

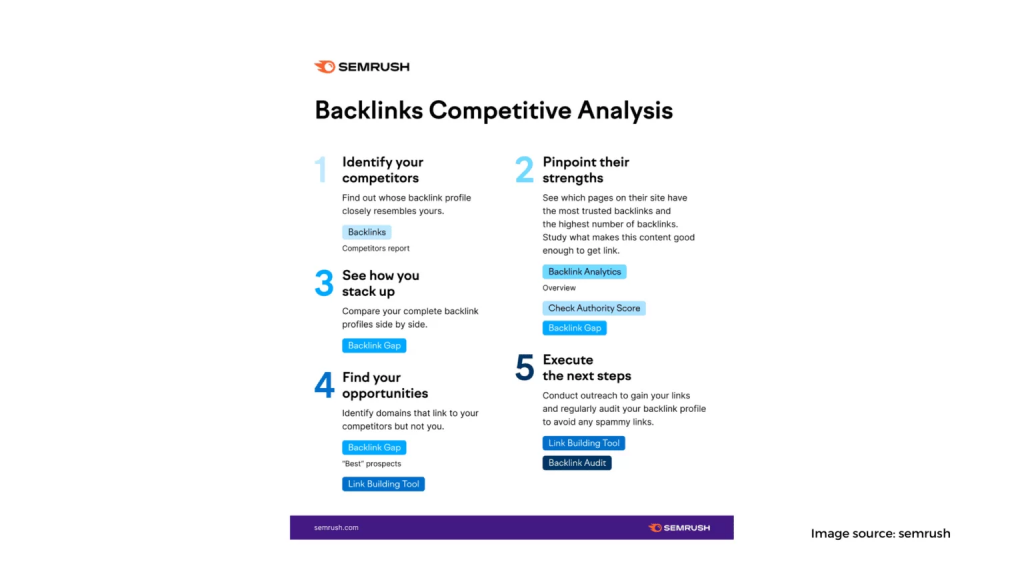

Consider what you could learn from your competition’s backlinks. Consider this: You’ve already done the hard work; all you have to do now is look at their links and see whether they’re worth your time.

Replicating your competition’s backlinks takes a lot of the legwork out of SEO and link building. It’s also simple for a novice to do. Here’s how to do it in three easy steps.

To begin, type in your chosen term and retrieve the URLs for the top results of a search. Simply conduct a Google search and keep track of each URL that comes up.

In this example, I looked for “financial advisor Chicago” and got these results. (I highlighted the link I investigated!). Checking the top search results for the keyword and selecting the best option.

I use SEMrush to research competitor backlinks since it’s the simplest tool to use and it provides a lot of data.

Putting one of the search results into SEMrush to get competitor data.

Here’s what I see after I research their backlinks:

I scrolled down to the bottom of the search results page and found a list of backlinks relating to the URL I had chosen. I clicked on the first link just to see what would happen. D3 Financial Counselors were included in a list of top financial advisors in Chicago, as I discovered. It’s fantastic!

Now, all that’s left is to go through each of the links one at a time.

Keep a running list of everything you do and who you email, and make sure to keep track of it all. I recommend using a CRM like Capsule so that you may see what works and what doesn’t.

Finally, don’t count on this approach. The goal of link building is to surpass your rivals, not just keep up with them.

Even if you manage to acquire every single one of their connections, which is unlikely, you must obtain links from sources that your rivals do not have.

It was simpler to get away with quantity rather than quality in the early days of SEO. Google might reward you with more exposure if you published a blog article on a daily basis, for example, based on the amount of material you produced — but those days are long gone.

Google now values quality, and your website will be penalized if it contains outdated or low-value material. If you fill your financial advisor’s website with blogs that don’t attract visitors or result in appointments, follow Schulte’s example: perform a content cleanup.

Keeping it clean is key. According to Stephen, most bloggers find that if they just take a close look at their site and delete anything that isn’t directed toward their target market or isn’t good, they can free up enough time in the day so they don’t feel like they’re working seven days a week.

With your existing blog material, the next stage is to refresh and combine it. What can you do to make your blog even more useful? Here are some suggestions for how you may enhance your blog:

Don’t forget to update the dates on your blogs after you’ve optimized them. If you wrote a blog in 2016 and haven’t updated it, Google won’t see the difference, and Google likes to see progress before giving you SEO credit.

Next, you should combine any blogs that would be more effective together than apart. A lot of financial advisors are blind to the fact that you may cannibalize your material by following arbitrary restrictions on how many blogs you should produce and what you should write about.

Schulte understands the significance of a successful website, and he’s spent more than $50,000 in the last six years improving it. I’m not suggesting you do this, but you should reconsider your website, especially the homepage; in fact, he claims that’s when you should start.

You can include CTAs after showcasing your services such as, financial planning needs, exchange traded funds, financial life,

Your website’s home page is the first thing potential clients see, so inform them who you are and how you can assist them right away. When you arrive at Schulte’s company website, for example, “Retirement Planning For People Over Age 50,” is the first thing you notice. He then informs you that he can assist with tax reduction, financial expertise, and income optimization.

When your SEO and marketing efforts attract the clients you need, it’s time to expand your company. That’s where your call-to-action comes in handy.

You should have only one clear CTA on your homepage for your desired next step — not three, ten, or even thirty. It’s simply a single task. Whether it’s joining your mailing list, making a call, or downloading a lead magnet, the goal is to make it as simple as possible for visitors and potential clients to do so.

Typically, CTAs on financial advisor websites include things like “see more,” “contact us,” or “make a appointment.” That isn’t very appealing, is it? Those buttons appear on a lot of other websites, so prospects are unlikely to pay attention to them.

In one fell swoop, you can improve your CTA and eliminate customers who aren’t interested in doing business with you. It’s a win-win situation.

Your website needs proper titling and descriptions on the backend.

You’ll also want to give your website a name and describe it — this way, search engines will know who you are, what you do, and when to display your website to people that search for the keywords you rank for.

We previously discussed meta descriptions, so let’s look at other strategies you may use to connect your online presence with search engines.

There are two ways you can do this:

It’s not the end of the world if WordPress doesn’t host your website. Website builders like Wix or Squarespace make it simple to modify titles and descriptions frequently.

Inbound marketing for financial advisors isn’t complete without a social media presence. Why? It’s where your potential clients are spending time.

Even in the financial services sector, having a vague social media presence might harm your brand and put you at a disadvantage.

Because correlation does not equal causation, I didn’t include this as one of the suggestions. The idea is that content shared a lot on social media is perceived to be more valuable by search engines. However, Google has repeatedly denied using social media signals for SEO ranking purposes. Furthermore, social networking sites employ nofollow links, which provide zero link juice.

Viral marketing refers to the creation and sharing of content on social media with the goal of getting users to take a desired action. This could be anything from visiting your website to making a purchase.

You can use a number of growth hacking techniques to increase traffic to your website. Schulte applied a simple but effective strategy: He reached out to popular bloggers in his industry and asked if they would be willing to write about him.

In any case, you should encourage sharing and organic traffic by posting high-quality information on social media.